Press Release.

Breaking Barriers: Gender Lens Investing reshaping financial landscapes

Innovative research explores role of gender lens investing in sustainable growth

Suggested references: Bocconi University, Phenix Capital Group, Politecnico di Milano and UN Women. 2024. EMPOWERING WOMEN, BUILDING SUSTAINABLE ASSETS. Strengthening the depth of gender lens investing across asset classes

Milano, 13th February 2024- A report focused on advancing gender equality through impact investing and sustainable finance was released. ‘Empowering women, building sustainable assets: Strengthening the depth of gender lens investing across asset classes’ was prepared by UN Women, in collaboration with Politecnico di Milano (TIRESIA), Phenix Capital Group and Bocconi University – Axa Research Lab on Gender Equality.

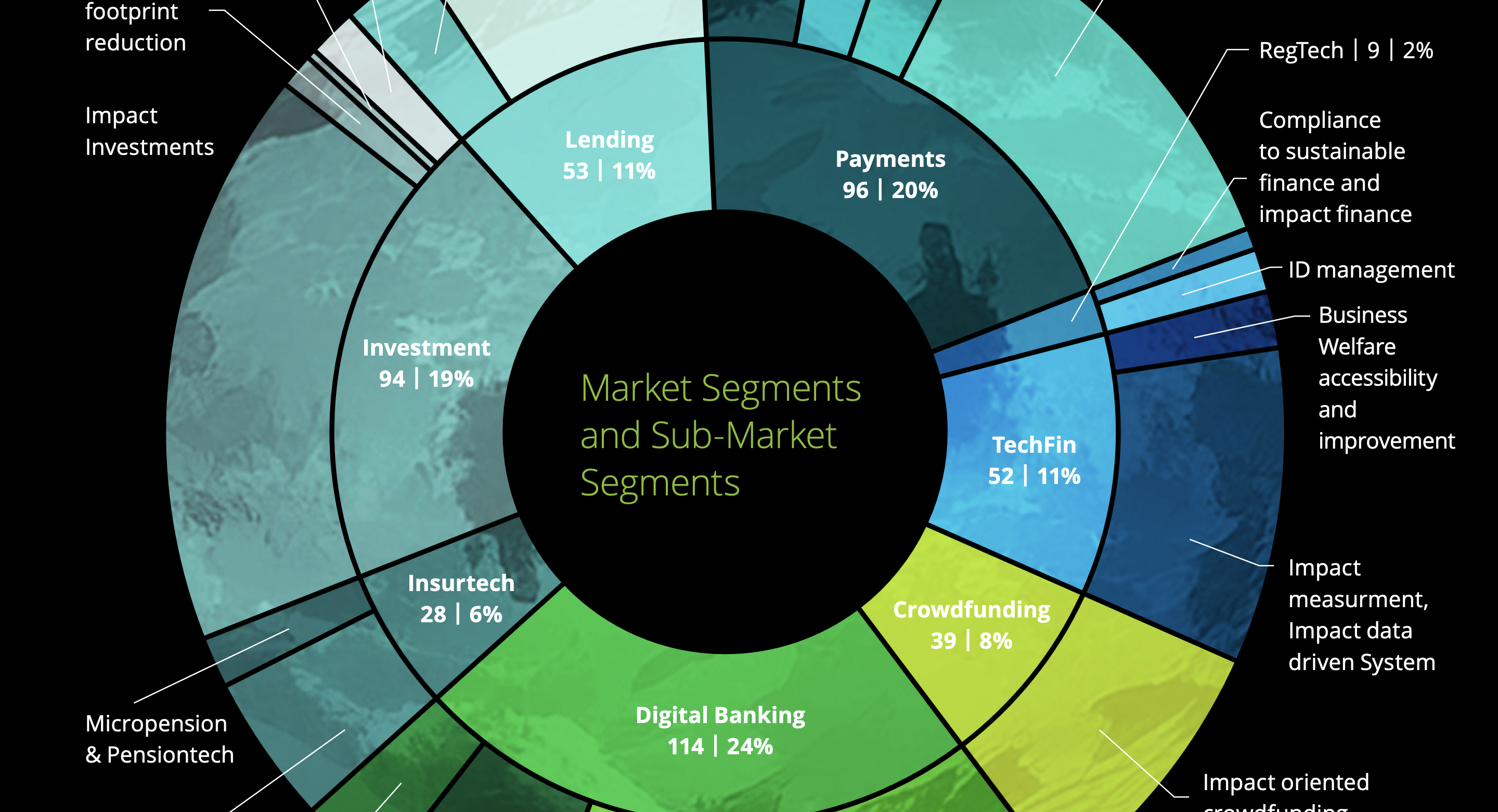

The report explores the Gender Lens Investing (GLI) market through quantitative and qualitative analysis. The GLI approach places gender equality at the centre of investment decisions with the aim of reducing gender inequality through the strategic allocation of economic resources.

The report highlights the lack of consensus on the definition of equality and inclusion in the financial sphere, stressing the urgent need for better financial literacy. Improving financial education is a key step to incorporate gender issues into investment decisions.

Investors are increasingly aware of the importance of quantifying and reporting the impact of their investments, by adopting measurement practices that consider gender and equality issues, thus actively contributing to the success and positive impact of such initiatives.Top-down initiatives, including stricter regulations, are welcomed by the investment community, and foster the acceleration of gender and equality initiatives.

The key findings of the report provide a detailed overview of the investment market targeting UN Sustainable Development Goal (SDG) 5, which promotes gender diversity. As of July 2023, invested capital reached the remarkable amount of USD 56 billion, reflecting the growing demand for SDG 5-related impact investment funds. Private equity is confirmed as the most mature impact strategy, as the asset class boasts the largest number of investment funds (41) and significant allocated capital. Investments in real assets – real estate and infrastructure – also saw an increase in initiatives in 2022, despite the limited number of funds.

This groundbreaking report not only reveals important findings, but also highlights the great contribution of Gender Lens Investing to society. By strategically allocating capital to address gender inequality, GLI offers a practical and potentially impactful solution to tackle the chronic underfunding of women’s empowerment and gender equality initiatives.As the world strives to achieve the ambitious goals set by the United Nations 2030 Agenda, this report proves the potential of Gender Lens Investing as a transformative force for positive change, breaking down barriers and paving the way for a more inclusive and fair future.

‘We have not yet been able to make impact the main focus for financial institutions to generate value,’ comments Mario Calderini, director of Tiresia, Politecnico di Milano. ‘One of the most immediate reasons to explain why this has not happened is in the composition of the boards of large financial institutions: who was not sitting there? Women. I strongly believe that the impact revolution will depend on more inclusion, more women and more gender diversity in decision-making bodies’.

‘Gender equality is one of the great challenges of our time,’ emphasises Paola Profeta, director of AXA Research on Gender Equality and Vice Rector for Diversity, Inclusion and Sustainability at Bocconi University. ‘Although the economic benefits of gender equality are now clear, progress is slow. This report analyses the role of finance and investors in promoting financial instruments that foster inclusion and sustainable development starting from gender equality. ’

“The report was inspired by the observation of SDG 5’s low ranking in the breakdown of capital allocated by institutional investors across the Sustainable Development Goals,” says Chiara Borneman, Director at Phenix Capital Group. “The report outlines opportunities to invest with a gender lens objective alongside investment returns, across asset classes. It has been very exciting to see the different ways investments can make an intentional positive impact on women and girls”.